When $500 a Month Changed Everything: Two Real Stories of Smarter Wealth Building

Is your money working as hard as you are?

Every day, we meet people who are doing everything right. They budget. They save. They follow the rules.

But even with years of disciplined saving, many still feel behind, stuck with accounts that grow slowly, offer little protection, and come with tax headaches down the road.

What if the problem isn’t your discipline…

But your strategy?

In this post, we share the stories of two clients —Chris and Mark— who decided to rethink how their money could work for them. With the same monthly budget, they didn’t just save for retirement… they built tax-free income, living protection, and family legacy into their financial plan.

And the results? You’ll want to see for yourself.

Story #1 – Chris Thought He Was Doing Everything Right…

Chris is 40. Responsible. Disciplined. For years, he’s been setting aside $500 a month into his savings account like clockwork.

His bank told him it was safe. His accountant said it was smart. And in many ways, it was.

But when Chris came to us at Grundy’s Consultancy, something was bothering him.

“I’ve been saving for over a decade,” he said. “But when I look at what I’ve got, I don’t feel any closer to financial freedom.”

We took a look.

“I want to make sure I have something when I retire. I’m not trying to get rich, just… safe,” he told us.

And that was the problem. Chris wasn’t investing. He wasn’t strategizing. He was parking his money.

His savings had grown, yes. But taxes were eating into it. Inflation was dragging it down. And worst of all? That money wasn’t protected, growing with purpose, or accessible without penalties.

So we asked him one question that changed the entire conversation:

“What if your $500 could do five jobs instead of one?”

Chris raised an eyebrow. So we broke it down.

We showed Chris something different: a strategy that used the same $500/month, but with a bigger vision.

Rerouting the $500: Not More Money, More Purpose

We didn’t ask Chris to contribute more.

We just changed where the money goes.

Instead of depositing into a taxable savings account that earns modest interest and offers zero protection, we showed him how to channel the same $500 into a properly structured Indexed Universal Life (IUL) policy.

This wasn’t about insurance.

It was about transformation.

Here’s What Chris’s $500/Month Now Does:

- Builds Tax-Free Wealth

His money now grows inside the IUL without taxes eroding it each year. That’s compounding with purpose and protection. - Provides Downside Protection

Chris is no longer worried about market crashes. The IUL has a 0% floor, meaning his cash value won’t lose money when the markets dip.

“I used to panic every time the market dropped. Now I sleep fine.”

- Unlocks Access Before Retirement

Unlike a 401(k) or IRA, his IUL gives him penalty-free, tax-free access to his cash value before age 59½.

So if Chris needs funds for his daughter’s college, a family emergency, or even an opportunity, his money is ready.

- Includes Living Benefits

If Chris gets diagnosed with a chronic, critical, or terminal illness, his IUL lets him tap into the death benefit while he’s still alive.

“I didn’t even know life insurance could do that.”

- Leaves a Legacy

Whether he uses the policy or not, Chris’s family is protected. The IUL ensures a tax-free death benefit, helping his kids avoid financial hardship and even fund their futures.

What Changed for Chris?

Chris didn’t just buy a financial product.

He took back control.

Before:

- Uncertain retirement

- Tax drag on savings

- Zero protection

- Money growing slowly

After:

- A clear, tax-free roadmap to retirement

- Multiple safety nets built into his plan

- A legacy he can leave behind, proudly

- And the ability to access funds on his terms

“It’s like my money got a second job,” Chris joked.

“Only this one works 24/7 and never calls in sick.”

Story #2 – The Day the Numbers Spoke Louder Than Doubt

Not every client is like Chris.

Some don’t care about emotional security or the “what ifs.” They want the math. Cold, hard, no-fluff.

That was the case when Adam sat down with a client named Mark.

Mark is 42, runs a small consulting business, and prides himself on making data-driven decisions. He came in skeptical, arms crossed.

“Listen,” he said, “I already max my Roth, I’ve got a SEP IRA, and I stash $500 into my HYSA. I don’t need another account.”

Adam didn’t flinch. He just nodded and asked:

“Want to run a quick simulation with me?”

Mark agreed. Out came the whiteboard. What followed was a side-by-side that made Mark lean forward for the first time that day.

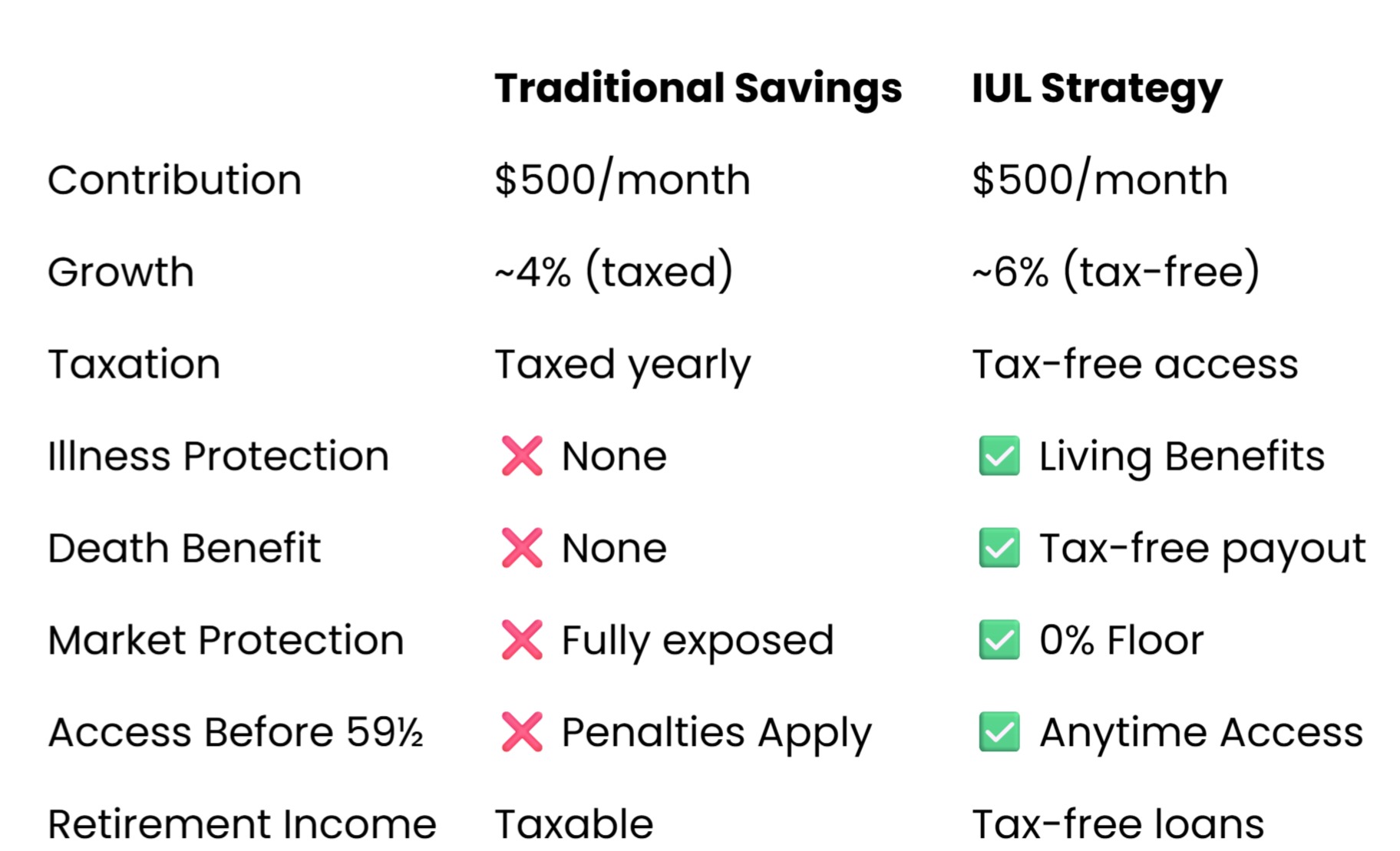

The Simulation: Same Dollars, Two Destinies

The Setup:

- Age: 42

- Monthly contribution: $500

- Time horizon: 25 years

- Goal: Create future income and liquidity

Scenario A: Traditional Savings Path

Mark’s current strategy was to deposit $500/month into a savings account earning around 4% interest annually.

Sure, it’s “safe.” But that interest is taxed every year. And that account?

- ❌ No protection if he gets sick

- ❌ No death benefit for his family

- ❌ No tax advantage at withdrawal

- ❌ No leverage or long-term strategy

Over 25 years, he would have contributed $150,000, and with compound growth (post-tax), he might end up with around $230,000.

It’s money, yes. But it’s fragile money. One illness, one emergency, one recession away from disappearing.

Scenario B: IUL Strategy

Now we imagined redirecting that same $500/month into a properly structured Indexed Universal Life policy.

No, it’s not an “investment.”

It’s a strategy.

This time:

- Money grows tax-deferred

- There’s a 0% floor—no losses in market downturns

- Historical returns modeled around 6% average, depending on the carrier and strategy

- Includes living benefits

- Provides a tax-free death benefit

- Offers tax-free income in retirement via policy loans

By retirement, Mark would be looking at $300,000–$400,000 in available tax-free income, depending on structure and policy performance.

But here’s where it clicked:

“Wait,” Mark said, “you’re telling me this account gives me money when I retire, protects my family if I die, AND pays me if I get sick?”

Adam replied:

“Exactly. And we’re using the same $500.”

Side-by-Side: The Visual That Changed Everything

What Changed for Mark?

He didn’t ditch his savings account.

He repurposed it.

By reallocating just one piece of his monthly cash flow, Mark built:

- A tax-free retirement fund

- A protection plan against life’s worst-case scenarios

- A legacy for his children

- And a mindset shift from “saving” to wealth building with purpose

“I thought I was being safe,” Mark said.

“Turns out I was being limited.”

Final Takeaway – It’s Not About Having More Money. It’s About Using It Better.

Chris was emotional. Mark was analytical.

But they both reached the same conclusion:

“If I’d known this earlier, I would’ve started years ago.”

You don’t have to contribute more.

You just need to redirect what you’re already doing… into something smarter.

Want to Run Your Own Simulation?

Whether you think in spreadsheets or life goals, we’ll meet you where you are and show you how to make your money do more.

FAQ

What exactly is an IUL?

An Indexed Universal Life (IUL) insurance policy is a flexible, permanent life insurance policy that combines death benefit protection with cash value growth tied to a market index (like the S&P 500®). It offers tax-deferred growth, tax-free withdrawals (if structured properly), and living benefits for illness or emergencies.

How is it different from a savings or retirement account?

Unlike savings or retirement accounts:

- IULs aren’t taxed annually

- There’s no market loss thanks to the 0% floor

- They offer early, penalty-free access

- And they come with built-in protection for your family and health

It’s not just a place to park your money, it’s a financial engine.

Isn’t life insurance just for when I die?

That’s old-school thinking.

Modern IULs offer living benefits, which allow you to access your death benefit if you’re diagnosed with a chronic, critical, or terminal illness. Plus, the cash value you build can be used during your lifetime for retirement, emergencies, or opportunities.

How much do I need to contribute?

There’s no one-size-fits-all answer. Some start with as little as $250/month. In Chris and Mark’s case, they redirected $500/month, but what matters most is structuring the policy properly based on your age, goals, and timeline.

What happens if I stop paying?

IULs are flexible. If you’ve built enough cash value, your policy can self-sustain for a time. Plus, you’re never locked in like with traditional retirement accounts.

What if I already have a 401(k) or IRA?

That’s great! An IUL isn’t meant to replace everything, it’s meant to fill the gaps. Things like tax-free retirement income, emergency access, and illness protection aren’t built into most traditional plans.

How do I know if an IUL is right for me?

That’s what we’re here for. We’ll look at your current budget, timeline, and goals to design a custom strategy that makes your money work smarter, just like we did for Chris and Mark.

Still have questions?

Let’s talk. Your financial strategy deserves more than a guess.